History of the European Printed Circuit Board Market

by: Frank-Ralf Mayer

The foundations for the development of the printed circuit board (PCB) were set in Japan, the USA, and in Europe. The Austrian born Mr. Paul Eisler invented the printed circuit board. After his emigration to the UK in1943, Eisler applied for British Patent 639,178. "Manufacture of Electric Circuits and Circuit Components" in London.

Printed circuit board (PCB) fabrication in Europe, Japan, and the USA was the first to grow where there were sufficient trained personnel for predominantly manual production. In addition, there was the closeness to the companies with rapidly growing demand for increasingly smaller and more complex electronic circuits.

The new equipment of the consumer appliance industry, home appliance industry, telecommunications and machinery industry spurred the development of the circuit board. Developments in aerospace, defense technology (radio and radar technology) and the rapidly emerging computer industry required increasingly powerful electronics. This also led to the introduction of new technologies and manufacturing techniques. Secure and reliable local supply chains, manufacturers' fear of product piracy, and the lack of global fast logistics allowed the PCB industry to emerge and grow where the customers were located, in Europe, Japan, and the USA.

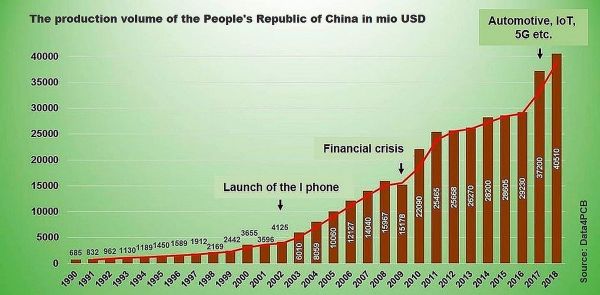

In 1980, America, Europe and Japan shared 80% of world production of printed circuit boards among themselves. In the meantime, these regions together have a share of less than 15%. In contrast, China had a share of only 2% in the world production of printed circuit boards in 1980.

In terms of production, volume, China accounted for around 52% in 2020, Taiwan for 11.5%, South Korea for 10.8%, Japan for 8%, and Thailand and Vietnam combined for 6.7%. Overall, this means that 89% of printed circuit boards came from Asia in 2020. The Americas accounted for 4.9% of total sales, Europe for 3.7%, and the rest of the world for 2.4%. In Europe and America, many of the supply chains that once existed have been lost with the relocation of production to Asia. Missing production facilities can be replaced buy any lost "know-how" is very difficult to replace.

Printed circuit board production in Europe peaked in 2018 at €1921 million. Already in 2019, 1 year before the Corona pandemic, production shrank by 8.2% and in the Corona year 2020 by another 12.2%. With a return to normality in H2-H3 2021, the bottom should be reached.

Compared to the year 2000, when printed circuit boards with a total value of 4.5 billion euros were still produced in Europe, the total market in 2020 shows a shrinkage of more than 67%. The European printed circuit board market shrank again by 12,2% in 2020. The total market is currently estimated at 1.550€ billion.

The performance of the three largest PCB manufacturing countries was mixed. German Printed Circuit Production contracted 10.4% year-on-year in 2019 and by a further approx. 10.9% in 2020. Swiss and Austrian PCB production only shrank by 8.2% in 2019 and 4% in 2020 due to their customer industries such as medical. The Italian PCB industry was hit the hardest with -8.4% in 2019 and -15.5% in 2020.

In the share of all printed circuit boards manufactured in Europe, the industrial sector takes 40.9%, automotive 20.2%, defense 8.8%, medical 8.4%, aerospace 5.1%, communications 4.2%, consumer 2.2%, computer 0.8% and other 9.4%.

The structure of predominantly medium-sized, family- owned companies as PCB manufacturers makes a market overview of PCB-Manufacturers in Europe not easy. The generally available statistics often neglect the fact that for some PCB manufacturers the lion's share of the company's production comes from the world's low-cost workbenches in Asia.

Four strategies of PCB-Manufacturers have emerged that have proven successful to date:

Lower wages, more favorable local structures and shorter decision-making paths in the target country were usually motivation enough to shift production capacities from Europe to the world's low-cost workbenches. Nevertheless, new innovative and disruptive manufacturing technologies, such as inkjet technology, could turn this trend around. Decisiveness and the will to push given technical boundaries will always lead to new solutions. Being close to the world's leading manufacturers and suppliers of automation solutions is once again proving to be an advantage. All this will reopen the way for highly flexible, globally competitive manufacturing environments in Europe. Miniaturization and finer structures for new product ideas. We at Taiyo will accompany you in this process with our ideas and new products.